extended child tax credit 2022

Child Tax Credit CTC The Child Tax Credit CTC is a tax benefit granted for parents of qualifying children. 9 Californias governor signed SB 114 which creates new Labor Code Section 2486The law takes effect immediately and is retroactive to Jan.

26 Solar Tax Credits Extended Until 2022 Florida Power Services The Solar Power Company

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

. Orphans benefit Unsupported child benefit is up 26 percent for under 5s - 25495 a week compared to 20303 Family Tax Credit for eldest child is up 13 percent - 12773 a week compared to 11304. The age range also has been expanded making 17-year-olds eligible for the first time. Gosnell beats Blytheville 26-20 to move to 6.

For families with a child aged under 13 their payments under the Family. 1 2022 the child tax credit reverted to what it was originally. Congress let it expire.

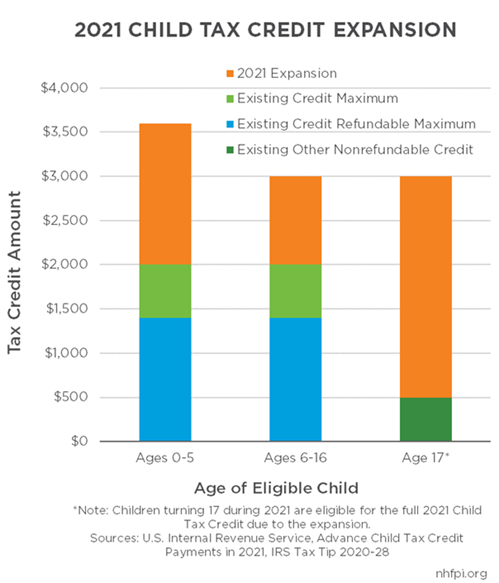

The Helping Working Families Afford Child Care Act Change in Individual Income Tax Revenue 2015-2024 billions Baseline. 1 but an employers obligation to provide. Now its been boosted to 3600 for children younger than 6 and 3000 for older children.

In January the Biden administrations one-year expansion of the child tax credit CTC program expired after Congress chose not to renew itBeginning in July 2021 the program gave American parents up to 3000. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments.

Eligible caregivers are still. How the Extended Child Tax Credit Could Make a Comeback. But the changes were.

150000 if you are married and filing a joint return or if. The maximum credit for taxpayers with no qualifying children is. It was a program created in 2021 that only lasted for that calendar year.

Congress allowed the expanded tax credits to expire at the end of 2021. 2022 FFN Game of the Week. For children under 6 the amount jumped to 3600.

That legislation has since stalled. Getty As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

In 2021 Congress passed the American Rescue Plan which expanded the child tax credit for most American families increasing the amount to 3600 per child under 6 and 3000 for kids 6 to 17. 18 hours agoParents of children likely recall the expanded child tax credit quite well. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

For 2022 that amount reverted to 2000. And the credit. Have a qualifying child.

Discover Helpful Information And Resources On Taxes From AARP. Sorting out those issues will be key if the federal government ever revives the program of sending partial tax credits to families as monthly payments. IRS wants millions to claim child tax credit stimulus funds.

The last round of monthly child tax credit payments will arrive in bank accounts on dec. The Child Tax Credit was significantly expanded in 2021 by the American Rescue Plan so families could receive up to 3600 per child under 6 and 3000 for those ages 6 to 17. The bill signed into law by President Joe Biden increased the Child Tax Credit from 2000 to up to 3600 and allowed families the option to receive 50 of their 2021 child tax credit in the form.

The legislation made the existing. Taxpayer income requirements to claim the 2022 child tax credit. Child Tax Credit 2022 Families can claim direct payments worth up to 3600 due to IRS mistake see if you qualify.

This means that the credit will revert to the previous amounts of 2000 per child. It hasnt been extended through 2021 and as of Jan. 100s of Top Rated Local Professionals Waiting to Help You Today.

According to the Tax Policy Center the price of reverting to the old child tax credit for 2022 would be about 1255 billion whereas the more generous benefit of 2021 which doesnt exclude or. 1 Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. The most important requirement is the tax return.

Filed before August 31 2022 or if they have filed an extension file before the extended filing due date of October 17 2022. 2000 per child in the form of a tax refund instead of monthly payments. Have been a US.

The expanded Child Tax Credit was worth 3000 for children ages 6 to 17 and 3600 for children under 6 in 2021. Shaheens Child and Dependent Care Tax Credit CDCTC Proposal. Here are the child tax benefit pay dates for 2022.

Current Law Distribution of Federal Tax Change by Expanded. The program provided. AB 2589 from Los Angeles-area Assemblyman Miguel Santiago would expand the Young Child Tax Credit to provide a one-time 2000 tax credit per child to families earning 30000 or less per year.

Ad Parents E-File to Get the Credits Deductions You Deserve. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. As such there was.

Tax deadline extended. The federal American Rescue Plan Act of 2021 greatly expanded the CTC allowing for qualifying families to receive monthly CTC checks from the IRS as of July. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for spouses filing a joint return.

This credit is also not being paid in advance as it was in 2021. Families only received half so they are waiting to receive the other half this year. By Region 8 Newsdesk.

The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan.

What Is The Child Tax Credit Tax Policy Center

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Biden Administration Relaunches Simplified Online Portal For Low Income Families To Claim Their Expanded Child Tax Credit

What Families Need To Know About The Ctc In 2022 Clasp

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

The 2021 Child Tax Credit Implications For Health Health Affairs

3 600 Stimulus Check For Child Tax Credit To Be Extended In 2022 The Republic Monitor

Oklahoma Families Need Economic Support Following The Ending Of The Expanded Child Tax Credit Oklahoma Policy Institute

Tax Season 2022 What To Know About Child Credit And Stimulus Payments The New York Times

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit 2022 Eligibility And Income Limits For 2022 Ctc Marca

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

What You Need To Know About Child Tax Credit Personal Capital

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit Is December The Last Monthly Payment Will They Be Extended Into 2022 Al Com

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News